With the UAE introducing a 9% federal corporate tax on business profits exceeding AED 375,000, effective from June 1, 2023, businesses across the country—excluding specific exempt entities—are now required to comply with the new tax framework.

Corporate tax will be calculated based on the net profit reported in financial statements prepared in accordance with internationally recognized accounting standards. This underscores the need for accurate and timely financial reporting, including proper audit procedures.

At MLS Accounting and Taxation LLC, we provide end-to-end corporate tax services to help your business stay compliant and prepared. Our experienced consultants assist with:

Stay Compliant and Optimize Tax Efficiency with MLS Accounting and Taxation LLC

Under the UAE Corporate Tax regime, corporate tax applies to both resident and non-resident taxable persons conducting business in the UAE.

1. Resident Taxable Persons

2. Non-Resident Taxable Persons

Non-residents may also be subject to corporate tax if they derive income from the UAE through:

While the UAE’s corporate tax law applies broadly, certain entities and types of income are exempt from corporate tax under specific conditions outlined in the legislation.

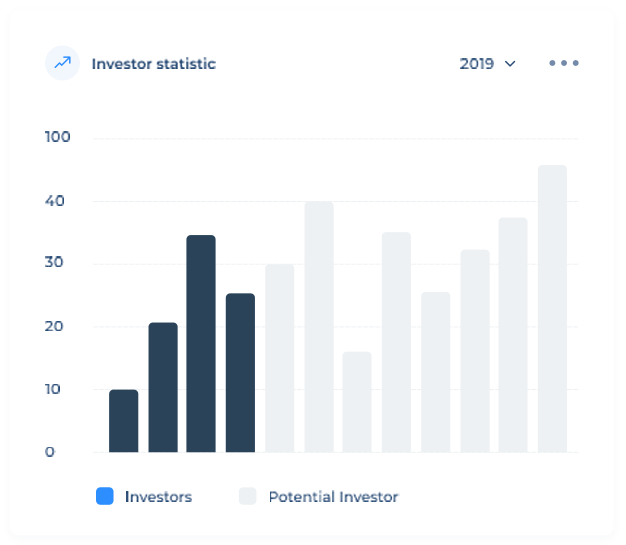

0% on taxable income up to AED 375,000.

9% on taxable income exceeding AED 375,000.

To ease the burden on start-ups and small enterprises, the UAE has introduced Small Business Relief under Article 21, offering eligible businesses significant tax and compliance benefits.

As per Ministerial Decision No. 73 of 2023, a resident person can elect to be treated as having no taxable income for a given tax period—if the following conditions are met:

The UAE’s Corporate Tax Law introduces a comprehensive Transfer Pricing (TP) framework, aligned with OECD Guidelines and based on the arm’s length principle. These rules apply to all transactions between related parties and connected persons, ensuring fair market value is maintained across intercompany dealings.

To determine an arm’s length price, the following OECD-recognized methodologies may be applied:

Comparable Uncontrolled Price (CUP) Method

Resale Price Method (RPM)

Cost-Plus Method (CPM)

Transactional Net Margin Method (TNMM)

Transactional Profit Split Method (TPSM)

At MLS Accounting and Taxation LLC, our TP specialists help businesses analyze, document, and defend intercompany transactions, ensuring full compliance with UAE TP regulations while minimizing audit risk.

At MLS Accounting and Taxation LLC, we’re more than just your service provider—we’re your growth partner. If you’re looking to explore reliable, expert-led accounting, bookkeeping, or tax services, we’re ready to help.

Navigating the corporate tax landscape in the UAE requires expertise and precision. With MLS Accounting and Taxation LLC, businesses can ensure compliance, optimize tax savings, and minimize risks, all while gaining valuable insights for strategic tax planning.

Here are some key benefits of utilizing corporate tax services in the UAE:

At MLS Accounting and Taxation LLC, we pride ourselves on being one of the leading tax advisory firms in the UAE, offering deep industry expertise and tailored tax solutions for businesses of all sizes. Whether you’re a local startup or a multinational corporation, our dedicated team of tax professionals is here to help you navigate the complexities of corporate tax in the UAE.

What sets us apart is our unwavering commitment to quality and client satisfaction. We understand that every business is unique, which is why we take the time to fully understand your specific goals before offering personalized solutions. Our team stays ahead of the curve by keeping up with the latest tax laws and regulations, ensuring you receive timely, accurate advice that aligns with local compliance requirements.

Consolidation is the process of combining financial data from various organizations in order to give a single picture of financial position. This is critical if your company has stock in other companies. Compliance with international financial reporting standards or USGAAP may be required due to regulatory requirements or business status.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo. commodo consequat. Duis aute irure dolor in reprehenderit in voluptate.

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Together, we harness creativity, experience, and cutting-edge technology to solve challenges, drive lasting impact, and cultivate trust.

© 2025 MLS Accounting and Taxation LLC • All Rights Reserved • Website Design and Developed by Upstyle Internet Marketing Agency

This will close in 0 seconds