Value Added Tax (VAT) compliance is a critical aspect of doing business in the UAE, where indirect taxation is governed by robust and evolving regulations. VAT consultancy services play a vital role in helping businesses understand and meet their obligations under UAE VAT law, while also identifying opportunities for tax efficiency and risk mitigation.

At MLS Accounting and Taxation LLC, we specialize in providing expert VAT consultancy services tailored to the diverse needs of businesses operating in Dubai’s dynamic commercial landscape. Our team of qualified VAT professionals possesses in-depth knowledge of local and international VAT frameworks, ensuring that clients remain fully compliant with Federal Tax Authority (FTA) requirements.

As one of the most trusted VAT consultants in Dubai, we offer a comprehensive range of VAT services, including:

VAT advisory and strategic planning

VAT registration and deregistration

Preparation and filing of VAT returns

VAT refund applications and claims

Review and reconciliation of VAT transactions

Ongoing compliance support and risk assessments

Our approach is driven by a commitment to accuracy, efficiency, and compliance. We work closely with clients to streamline their VAT processes, mitigate financial risks, and ensure timely and accurate reporting to the authorities.

Whether you are a startup or an established enterprise, MLS Accounting and Taxation is your reliable partner in navigating the complexities of VAT in the UAE.

Value Added Tax (VAT) was introduced in the United Arab Emirates on January 1, 2018, at a standard rate of 5% on most goods and services. As an indirect tax levied at each stage of the supply chain, VAT requires meticulous compliance, accurate record-keeping, and timely submissions to avoid penalties and ensure smooth business operations.

Navigating the complexities of VAT regulations in the UAE can be challenging, particularly for businesses unfamiliar with the framework or lacking internal resources. A qualified VAT consultant in Dubai can offer expert guidance, saving you valuable time and minimizing the risk of errors in VAT analysis, filings, and compliance procedures.

At MLS Accounting and Taxation LLC, we provide comprehensive VAT consultancy services tailored to meet the specific needs of businesses across various sectors in Dubai and the wider UAE. Our team of VAT specialists possesses extensive knowledge of UAE VAT legislation, administrative procedures, and reporting requirements.

Whether you’re facing difficulties with VAT registration, return filing, transaction classification, or system integration, our consultants can support you in ensuring full compliance. We assist businesses in overcoming operational challenges such as limited resources, outdated accounting systems, or limited understanding of VAT rules.

Trust MLS Accounting and Taxation LLC to be your reliable partner in managing VAT obligations efficiently and effectively.

VAT consultancy services in the UAE are tailored to the specific needs of each business, depending on its nature and operations. The core responsibilities typically handled by VAT experts include:

The role of a VAT consultant in the UAE, particularly in Dubai, may vary based on the client’s circumstances. However, the fundamental duties generally include:

Outsourcing VAT services allows businesses to access expert knowledge while reducing operational costs. It ensures accurate compliance with tax regulations, minimizing the risk of penalties.

Enhance Compliance and Optimize VAT Efficiency with MLS Accounting and Taxation LLC

At MLS Accounting and Taxation LLC, we provide expert VAT advisory services designed to support businesses in maintaining full compliance with UAE VAT laws while identifying opportunities for VAT optimization.

As a trusted financial auditor and advisor in the UAE, we understand the complexities of the VAT framework introduced by the Federal Tax Authority (FTA). Our VAT consultancy solutions are tailored to minimize the risk of non-compliance and potential penalties, while also maximizing your VAT efficiency.

We work closely with businesses to understand their operational structure and design practical, compliant VAT strategies. Our Dubai-based VAT consultants are equipped with the technical expertise and regulatory insight required to deliver tailored solutions that align with your specific industry and operational model.

Partner with MLS Accounting and Taxation to ensure your VAT affairs are in order—proactively, accurately, and strategically.

With the expertise of our experienced VAT consultants, we provide tailored solutions that ensure compliance and drive operational efficiency.

Get in touch with us today to streamline your VAT processes and take the next step toward financial clarity and compliance.

If you’re looking for reliable, expert-driven VAT Consultancy Services in Dubai, we’re here to help.

At MLS Accounting and Taxation LLC, we specialize in providing expert FTA VAT registration services in the UAE, with a primary focus on ensuring full compliance with Federal Tax Authority (FTA) regulations. As experienced financial auditors, we understand the critical importance of proper VAT registration for businesses operating within the UAE.

Our team of VAT professionals in Dubai ensures that the registration process is accurate, timely, and in full accordance with FTA guidelines—helping you avoid potential penalties and safeguarding your business reputation.

At MLS Accounting and Taxation LLC, we offer specialized VAT return filing services tailored to meet the evolving regulatory requirements in the UAE. Our goal is to alleviate the administrative burden on businesses while ensuring full compliance with the Federal Tax Authority (FTA) guidelines.

Our experienced VAT consultants in Dubai manage the end-to-end process—from meticulous data preparation to timely and accurate return submission—enabling you to concentrate on core business operations with peace of mind.

At MLS Accounting and Taxation LLC, we are proud to be a leading provider of VAT refund services in Dubai. Our team of experienced tax professionals is dedicated to securing the highest possible VAT refund from the Federal Tax Authority (FTA) on your behalf. With our deep expertise and in-depth knowledge, we ensure that you receive the refunds you are fully entitled to.

At MLS Accounting and Taxation, we specialize in guiding businesses through the VAT deregistration process in the UAE. If your company no longer meets the requirements for VAT registration, our experienced VAT consultants in Dubai will assist you every step of the way to ensure a smooth and efficient transition.

With MLS Accounting and Taxation, you can navigate VAT deregistration effortlessly. Contact us today to ensure your business transitions smoothly to VAT-deregistered status with the professionalism and efficiency you deserve.

MLS Accounting and Taxation LLC takes the lead in VAT claims by coordinating refund requests for VAT paid on business-related goods and services, including those used for the development and maintenance of algorithms.

To effectively file a VAT claim, it is essential to maintain comprehensive records of all VAT payments made on applicable expenses. A VAT return must also be submitted to the relevant tax authorities. The recoverable VAT amount is determined based on the nature of the incurred expenses.

Should any uncertainties arise regarding the VAT claim process, it is advisable to seek guidance from a qualified tax advisor.

Algorithm Accounting leads the VAT filing process, automatically reporting and remitting value-added tax (VAT) to government authorities. Algorithms play a critical role in this domain, automating data collecting and reporting, increasing accuracy, and saving time and financial expenses.

There are numerous options for including VAT filing with algorithm accounting. Tailored software programs and cloud-based services are attractive solutions for improving data management and compliance.

Whatever method is used, accuracy is critical. VAT, a multidimensional tax, needs accuracy to avoid government fines.

Here are some of the benefits of using algorithms for VAT filing:

By automating the detection and resolution of inconsistencies between businesses and tax authorities, Algorithm Accounting Dubai redefines VAT dispute resolution. Algorithms recognize possible conflicts and provide resolutions, speeding up the process while lowering costs.

Algorithms actively help to resolve VAT issues by:

Our VAT consultancy services in the UAE involve VAT registration, which formalizes your company’s relationship with tax authorities to ensure proper VAT collection and remittance. VAT registration is a critical operation in the context of MLS Accounting and Taxation LLC, facilitating efficient VAT monitoring and reporting for your transactions.

VAT registration procedures may vary by country, but generally, they require business details such as name, address, contact information, and possibly a sales tax identification number (TIN). Once registered, the VAT registration number uniquely identifies your company for VAT purposes.

VAT registration is mandatory for eligible businesses, with specific exemptions based on revenue and location.

Here are some of the benefits of VAT registration for MLS Accounting and Taxation LLC:

MLS Accounting and Taxation LLC is committed to offering reliable and expert VAT consultancy services to the corporate sector in Dubai. Our professionals possess a comprehensive understanding of local business intricacies and ever-evolving VAT legislation. We provide tailored solutions to ensure continuous compliance and optimized VAT savings. Contact us today to start your journey from accounting and bookkeeping to corporate tax services in the UAE. We manage it all, so you can focus on growing your business.

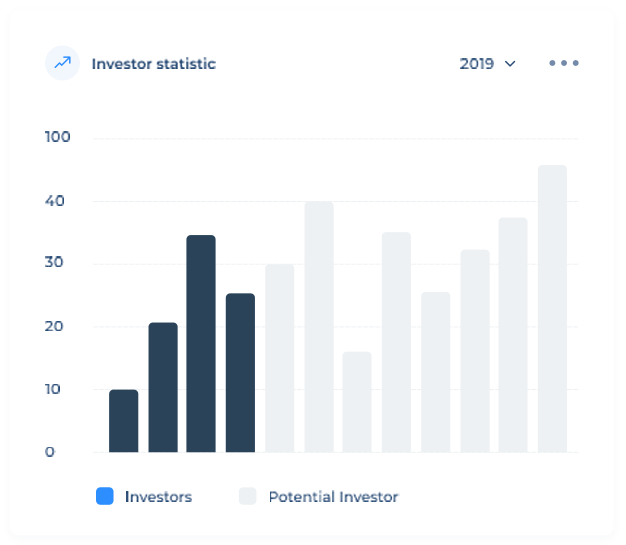

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo. commodo consequat. Duis aute irure dolor in reprehenderit in voluptate.

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Together, we harness creativity, experience, and cutting-edge technology to solve challenges, drive lasting impact, and cultivate trust.

© 2025 MLS Accounting and Taxation LLC • All Rights Reserved • Website Design and Developed by Upstyle Internet Marketing Agency

This will close in 0 seconds